Corporate Governance

- Basic Views

- Corporate Governance Systems

- Corporate Officers (As of January 22, 2026)

- Director Appointment

- CEO Succession Plan

- Director Compensation

- The Effectiveness of the Board of Directors

- Audits

- Internal Control System

Basic Views

The Kawasaki Group’s basic stance on corporate governance is to raise enterprise value through effective and sound management while forming solid relationships with all stakeholders, including shareholders, customers, employees, and communities, through highly transparent management practices. Our Group is striving to further strengthen and enhance corporate governance systems as appropriate for its businesses and scale.

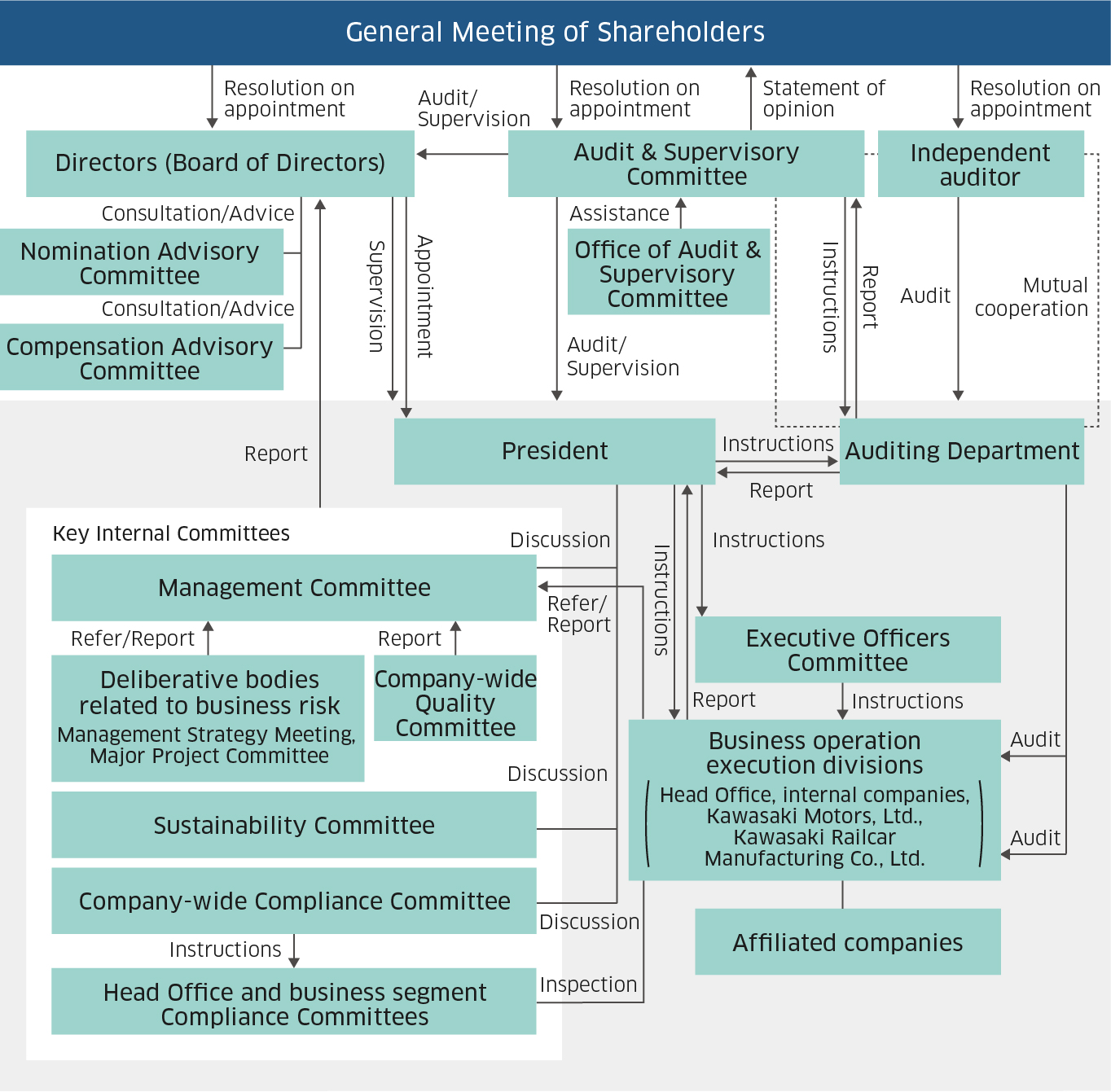

Corporate Governance Systems

Kawasaki is a company with an Audit & Supervisory Committee and has voluntarily established a Nomination Advisory Committee and a Compensation Advisory Committee as advisory bodies to the Board of Directors as well as a Management Committee, an Executive Officers Committee, and other business execution bodies. By avoiding having Directors serve concurrently as officers responsible for specific businesses (the internal company presidents, etc.), the Company seeks to enhance the separation of management oversight and business execution and thereby further reinforce the Board of Director’s oversight functions. Our main deliberative bodies and their details are as follows.

Board of Directors

The Board of Directors comprises 12 Directors (of whom four serve as Audit & Supervisory Committee Members), and seven of the 12 Directors are Outside Directors (of whom three serve as Audit & Supervisory Committee Members), comprising a majority of the Board. In addition, four of the Directors are women and two are foreign nationals, providing a balance of knowledge, experience, and skills, promoting diversity, and creating a system that enables more multifaceted decision making. Chairman of the Board serves as presiding officer the pursuant to a resolution of the Board. In addition to deliberating on individual proposals submitted in accordance with the internal rules, the Board of Directors also discusses topics set based on the results of evaluations of the effectiveness of the Board. In fiscal 2024, the Board discussed issues including our vision for group governance, strengthening of audit and compliance system, and business direction to enhance enterprise value. We also created a system whereby the Board adopts resolutions on fundamental policies on key management issues, such as sustainability, compliance, risk management, and quality control, and can request reports on the status of these issues from the business execution side. In addition to the above, the Nomination Advisory Committee and the Compensation Advisory Committee have been established for the purpose of improving the transparency and objectivity of its deliberations. The presiding officers and a majority of members of each committee are Outside Directors. The Nomination Advisory Committee deliberates on the policies and standards regarding the appointment and dismissal of Directors and the appropriateness of such, and the Compensation Advisory Committee deliberates on the policies and systems regarding the compensation of Directors and the appropriateness of the individual compensation, and reports or advises the Board of Directors, respectively.

Audit & Supervisory Committee

The Audit & Supervisory Committee comprises four Directors, including three Outside Directors. To secure effective oversight, an Internal Director has been appointed as full-time Audit & Supervisory Committee Member. To ensure the reliability of financial reports, at least one person with sufficient knowledge of finance and accounting is appointed to the Committee.

Business Execution Framework

Kawasaki has adopted an executive officer system in order to facilitate response to rapid changes in the business environment. To accelerate decision making, a great deal of authority over business execution decisions is delegated to the executive officers, who are appointed by the Board of Directors. The Company established a Management Committee consisting of Representative Directors, presidents of internal companies, and others as an advisory body to the President on overall Group management. The Committee deliberates on important matters related to business execution. The Company also established the Management Strategy Meeting and the Major Project Committee to engage in multifaceted discussions of strategies, action plans, and risk assessment and countermeasures for each business and project, thereby creating a system that enables more appropriate and efficient decision making and business execution. The Executive Officers Committee, chaired by the President and consisting of all executive officers, has been established. In addition to issuing business execution policies based on decisions made by the Board of Directors, the Committee also exchanges opinions on management issues in an effort to unify decision making in Group management.

Corporate Governance System Diagram (As of June 26, 2025)

Corporate Governance Functions (Organizations, Committees, Etc.)

| Name | Role |

|---|---|

| Nomination Advisory Committee | An advisory body on policy and standards for the appointment and dismissal of corporate officers and such appointment and dismissal. (Presiding officer: An Outside Director) |

| Compensation Advisory Committee | An advisory body on the policy for and systems of corporate officer compensation as well as individual compensation. (Presiding officer: An Outside Director) |

| Management Committee | A meeting body that assists the President as an advisory body with regard to overall Group management. Discusses important business execution issues. (Presiding officer: The President) |

| Executive Officers Committee | Issues instructions on business execution policy based on management policy and management plans determined by the Board of Directors as well as information on important matters decided by the Management Committee, and also reports on and communicates necessary and important information regarding business execution and holds exchanges of opinions. (Presiding officer: The President) |

| Sustainability Committee | Discusses and decides on various measures to promote social, environmental, and Group sustainability, and also monitors adherence to such measures and the achievement of their aims. (Chair: The President) |

| Company-wide Compliance Committee | Discusses and decides on various measures to ensure thorough compliance throughout the Kawasaki Group, and also monitors adherence to such measures and the achievement of their aims. (Chair: The President) |

| Company-wide Quality Committee | Discusses Company-wide quality control policy and ensures its application for the purpose of reinforcing Company-wide quality control systems, and also shares information about quality control among the Head Office, internal companies, and other related companies. (Presiding officer: The Senior Corporate Executive Officer in charge of technology) |

| Management Strategy Meeting | Discusses Company-wide business strategies and action plans based on analysis of the business environment of each business segment for the purpose of formulating and reviewing management strategies and management plans for each business segment. (Presiding officer: The President) |

| Major Project Committee | Evaluates and considers ways of addressing the risks of major projects that could significantly impact operations and financial performance for the purpose of managing risk before bidding on and making investment decisions regarding such projects. (Presiding officer: The general manager of the Corporate Planning Division) |

Corporate Officers (As of January 22, 2026)

| Name | Position at the company | Executive | Independent | Years of Service as a Director | Nomination Advisory Committee | Compensation Advisory Committee | Woman | Non-Japanese National | Board of Directors Meetings Attended* | Audit & Supervisory Committee Meetings Attended* |

|---|---|---|---|---|---|---|---|---|---|---|

| Yoshinori Kanehana | Chairman of the Board | 13 | 22/22 | - | ||||||

| Yasuhiko Hashimoto | Representative Director, President, and Chief Executive Officer | ○ | 7 | ○ | ○ | 22/22 | - | |||

| Katsuya Yamamoto | Representative Director, Senior Corporate Executive Officer | ○ | 8 | ○ | ○ | 22/22 | - | |||

| Hiroshi Nakatani | Representative Director, Senior Corporate Executive Officer | ○ | 5 | 22/22 | - | |||||

| Jenifer Rogers | Outside Director | ○ | 7 | ○ | ○ | 22/22 | - | |||

| Hideo Tsujimura | Outside Director | ○ | 5 | ○ Presiding officer |

○ Presiding officer |

21/22 | - | |||

| Katsuhiko Yoshida | Outside Director | ○ | 3 | ○ | ○ | 22/22 | - | |||

| Melanie Brock | Outside Director | ○ | 2 | ○ | ○ | 22/22 | - | |||

| Atsuko Kakihara | Director (Audit & Supervisory Committee Member) | 1 | ○ | 17/17 | 11/11 | |||||

| Susumu Tsukui | Outside Director (Audit & Supervisory Committee Member) | ○ | 3 | ○ | ○ | 22/22 | 18/18 | |||

| Tomoko Amaya | Outside Director (Audit & Supervisory Committee Member) | ○ | 1 | ○ | 17/17 | 11/11 | ||||

| Toshiaki Itagaki | Outside Director (Audit & Supervisory Committee Member) | ○ | New | - | - |

* Data on the number of Board of Directors meetings attended and Audit & Supervisory Committee meetings attended is for fiscal 2024.

Presiding Officer of the Board of Directors

The Chairman of the Board of Directors serves as the presiding officer of the Board of Directors.

Director Appointment

Director Appointment Process

The Board of Directors defined the “Qualifications Expected of Directors” and selects directors with extensive and broad experience, insight, and expertise. Furthermore, it promotes diversity in gender, ethnicity, nationality, and so forth to create a system that enables more multi-faceted decision making. The status of that system is summarized in a skills matrix. When selecting the skills and experience included in the skills matrix, we defined the areas of supervision as “vision, strategic thinking, and governance,” “business structure transformation,” and “growth initiatives related to infrastructure development” from the perspective of enhancing the Group’s sustainable corporate value by providing solutions to social problems, and we defined the skills and experienced required in each supervisory area as follows.

Skills and Experience Required in Each Area of Supervision

| Area of Supervision | Expected Skills | Expected Experience |

|---|---|---|

| Vision, strategic thinking, and governance | Business strategy / Governance / IT, DX & security |

Corporate management Global Legal & administration Finance |

| Business structure transformation | Business strategy / Monozukuri (technology, development, production & quality) /

Sales & marketing |

|

| Growth initiatives related to infrastructure development | Business strategy / Finance & accounting / Personnel & organizational management / Monozukuri (technology, development, production & quality) / Sales & marketing / IT, DX & security |

Reasons for Selecting Required Skills and Experience

The reasons for selecting these required skills and experience are shown in the table below.

| Expected Skills | Reasons for Selection |

|---|---|

| Business strategy | Because with regard to supervising growth strategies based on ambidextrous management, we expect knowledge and expertise in planning and implementing business strategies that entail reviewing business models, portfolio reform, and collaboration with national and local governments, other companies, and research institutions. |

| Governance | Because with regard to supervising the establishment of a governance structure that will be the foundation for continuous improvements to corporate value, we expect a broad range of knowledge and expertise in governance-related issues, including corporate governance, risk management, human rights, and compliance. |

| Finance & accounting | Because with regard to the laying of a firm financial base and supervising the furthering of growth investments and the strengthening relationships of trust with stakeholders such as shareholders, we expect knowledge and expertise regarding financial affairs and accounting. |

| Personnel & organizational management | Because with regard to supervising the formulation and implementation of personnel strategies for obtaining talented human resources and getting the most out of the talents of a diverse workforce, we expect knowledge and expertise regarding personnel and organizational management from a management perspective. |

| Monozukuri (technology, development, production & quality) | Because with regard to supervising the formulation and advancement of manufacturing strategies that will continue to present society with valuable solutions, we expect a broad range of knowledge and expertise regarding manufacturing including technology, development, intellectual property, production, quality, and safety. |

| Sales & marketing | Because with regard to supervising business development and information dissemination for innovations created from a "market-in" perspective, we expect knowledge and expertise in sales and marketing. |

| IT, DX & security | Because with regard to supervising the creation and advancement of solutions based on the use of AI and promotion of DX, we expect knowledge and expertise about IT, DX, and security. |

| Expected Experience | Reasons for Selection |

|---|---|

| Corporate management | Because the director will use their corporate management experience in order to supervise management of the entire company, including business strategies, corporate governance, sustainability, and personnel strategies. |

| Global | Because the director will use their experience in global strategy and policy formulation and their hands-on, overseas experience in business and organizational management to supervise global business growth and risk management. |

| Legal & administration | Because the director will use their experience in legal circles and government institutions in order to supervise governance, risk management, business strategies, etc. |

| Finance | Because the director will use their experience in financial institutions to supervise financial strategies, manufacturing, business strategies, etc. |

Directors skills matrix

The skills matrix for current directors is shown on the table below. Furthermore, we check for those skills about which increased discussion is expected.

| Name | Position at the company |

Expected skills | Expected experience | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Business strategy

|

Governance

|

Finance and

accounting |

Personnel &

organizational management |

Monozukuri

(technology, development, production & quality)

|

Sales & marketing

|

IT, DX & security

|

Corporate management

|

Global

|

Legal & administration

|

Finance

|

||

| Yoshinori Kanehana | Chairman of the Board | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Yasuhiko Hashimoto | Representative Director, President, and Chief Executive Officer |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||

| Katsuya Yamamoto | Representative Director, Senior Corporate Executive Officer |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||

| Hiroshi Nakatani | Representative Director, Senior Corporate Executive Officer |

✓ | ✓ | ✓ | ✓ | ✓ | ||||||

| Jenifer Rogers | Outside Director | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||

| Hideo Tsujimura | Outside Director | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Katsuhiko Yoshida | Outside Director | ✓ | ✓ | ✓ | ✓ | |||||||

| Melanie Brock | Outside Director | ✓ | ✓ | ✓ | ✓ | |||||||

| Atsuko Kakihara | Director (Audit & Supervisory Committee Member) |

✓ | ✓ | ✓ | ✓ | |||||||

| Susumu Tsukui | Outside Director (Audit & Supervisory Committee Member) |

✓ | ✓ | ✓ | ||||||||

| Tomoko Amaya | Outside Director (Audit & Supervisory Committee Member) |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||

| Toshiaki Itagaki | Outside Director (Audit & Supervisory Committee Member) |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

Director Appointment Criteria

Qualifications Expected of Directors

- Possess in-depth understanding and support for the Kawasaki Group’s management philosophy and vision.

- Be able to make positive contributions towards sustainable growth and the enhancement of enterprise value over the medium and long term.

- Maintain a Company-wide perspective and bring the wealth and breadth of experience, insight and expertise to do so.

- Be able to supervise the management and execution of business operations from an independent and objective position as a member of the Board of Directors.

- Be able to exercise one’s authority in an active and positive manner, and appropriately voice opinions at Board of Directors meetings or to management.

Note: To ensure the effectiveness of audits, Directors serving as Audit & Supervisory Committee Members must be familiar with the Company’s business or have deep insight and expertise in corporate management, legal affairs, finance and accounting, government and other fields. At least one Director serving as an Audit & Supervisory Committee Member must have sufficient knowledge of finance and accounting.

Independence Criteria for Outside Directors

If none of the following items apply, the Company judges that an Outside Director is sufficiently independent.

- In the event that a company (including an important subsidiary as defined by the Company) in which the Outside Director is currently employed or has been employed in the past 10 years as an executive director, executive officer, manager or other important employee (hereinafter referred to as the “originating company”) conducts business with the Kawasaki Group, the average transaction amount for the past five fiscal years exceeds 2% of the average net sales of the Group and the originating company for the past five fiscal years.

- The average amount of compensation (excluding compensation as an officer of the Company) received by such Outside Directors directly from our Group as a legal, accounting or tax specialist or consultant (or a corporation if the Outside Director has legal personality) for the past five fiscal years exceeds ¥10 million.

- The average amount of donations, etc. from the Group to the non-profit organization for which the Outside Director serves as executive officer for the past five fiscal years exceeds ¥10 million and exceeds 2% of the organization's total revenue or ordinary income/expenses.

- The company from which the Outside Director hails is a major shareholder holding 10% or more of the Company’s total outstanding shares.

- A relative within the second degree of kinship of the Outside Director is a person who meets the conditions set forth in the preceding four items or is an executive director, executive officer, manager, or other important employee of our Group.

CEO Succession Plan

Basic Policy

Through the formulation of a CEO Succession Plan, the Company aims to promote the further reinforcement of its corporate governance as well as to methodically train candidates through developing their ability by giving them challenging assignments and, in doing so, have the Kawasaki Group sustainably enhance its enterprise value. Through that CEO Succession Plan, going forward, the Company will continue to smoothly and firmly carry out succession to the next generation so that it may contribute to the solution of social issues.

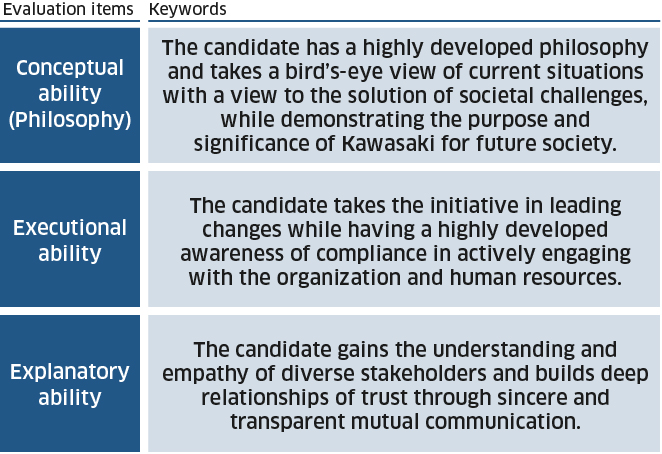

Human Resource Requirements for CEOs

The Company has established the following three criteria as essential human resource requirements among leaders to continuously innovate in technology to contribute to society, as well as to present “Trustworthy Solutions for the Future.” We evaluate management and business execution capabilities as CEO based on the essential human resource requirements which the Company emphasizes and monitor the statuses of their development.

Human Resource Requirements for CEOs

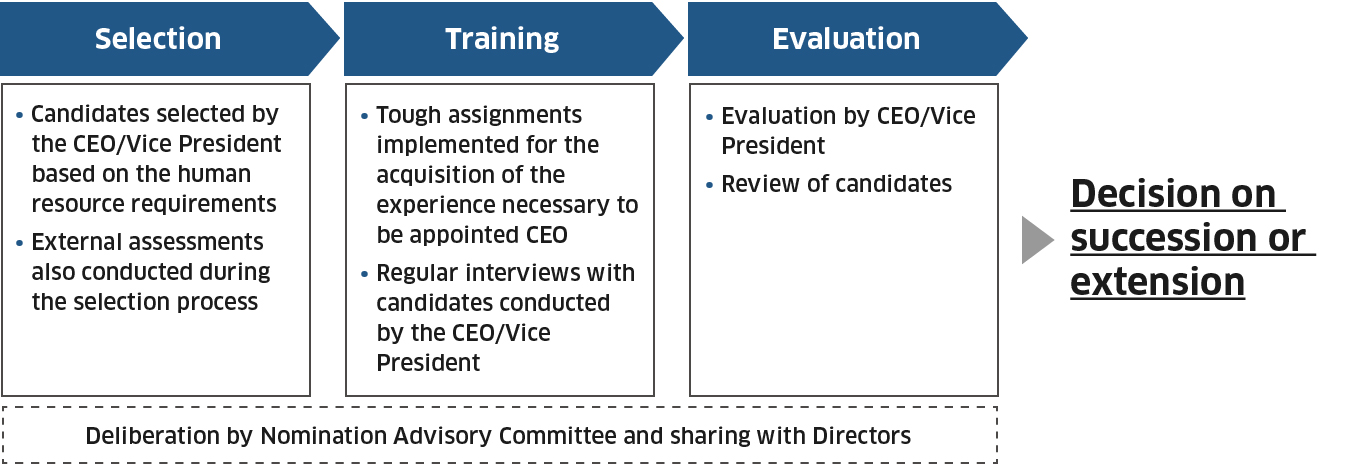

Selection, Training, and Evaluation of CEO Candidates

The CEO and Vice President undertake the selection of candidates based on the CEO human resource requirements and confirm their evaluations through external assessments designed to ensure greater objectivity in the selection process. In addition, the Nomination Advisory Committee deliberates annually on the selection, development, and evaluation of candidates, and shares its evaluation and outcomes with the Directors to ensure transparency and allow the Board of Directors to confirm the statuses of respective candidates in a timely manner.

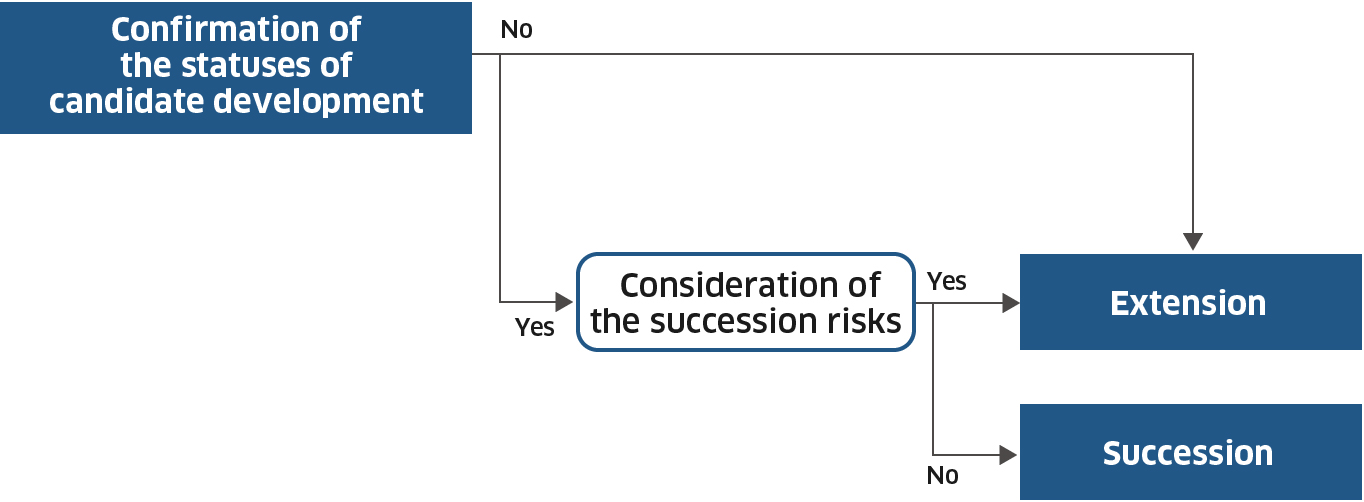

Determination Criteria for the Replacement of CEOs and the Extension of Their Terms

Changeover of the CEO is finalized via resolution of the Board of Directors, following comprehensive assessment of the business environment, management statuses, and the development statuses of candidates, and taking into account the opinions of the Nomination Advisory Committee.

Director Compensation

The compensation system for Directors (excluding Audit & Supervisory Committee Members and Outside Directors) is based on the following basic policy with the aim of achieving Group Vision 2030, “Trustworthy Solutions for the Future,” established in November 2020. In addition, at meetings held on May 9, 2024, September 21, 2024, and May 21, 2025, the Board of Directors adopted resolutions to partially revise the compensation system for the Company’s Directors (excluding Audit & Supervisory Committee Members and Outside Directors). Because the Company’s annual compensation period runs from July through June of the following year, from the annual compensation period beginning July 2025, compensation will be calculated in accordance with the policy following these revisions.

Basic Policy

Placing stronger emphasis on contribution to the Company’s goals, the revised compensation system is designed to reward each recipient based on their responsibilities and accomplishments. To this end, it not only provides short-term incentives but also rewards Directors for their contributions to medium- to long-term improvement in corporate value. In this way, we aim to promote the sharing of value between Directors and stakeholders, including shareholders.

Compensation for Directors (Excluding Audit & Supervisory Committee Members and Outside Directors)

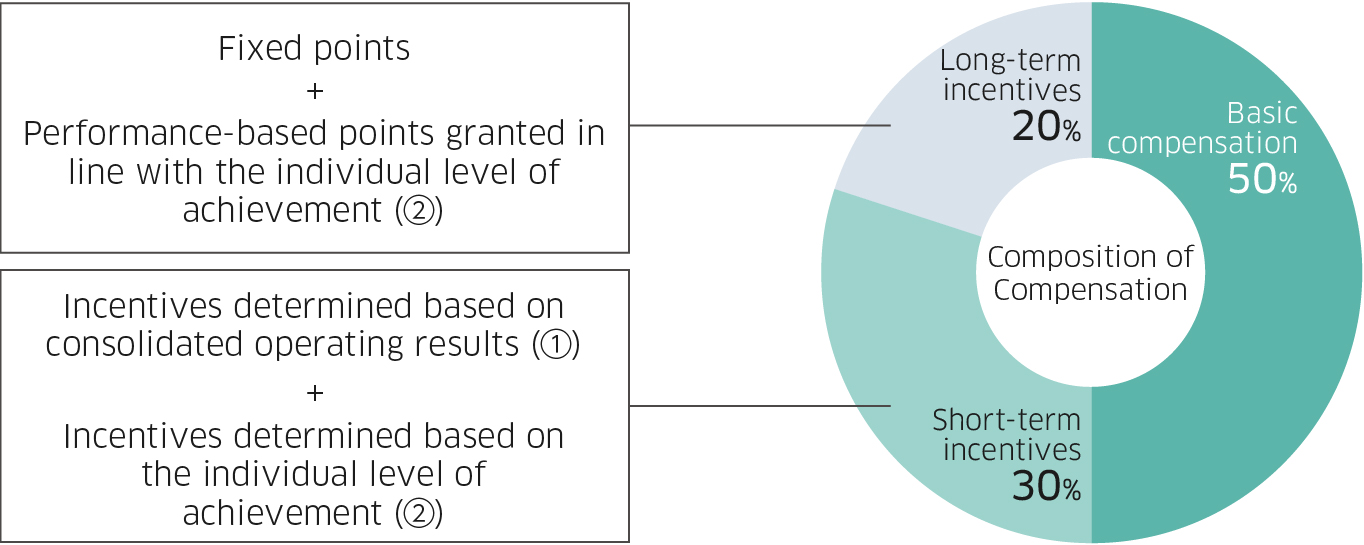

Compensation for eligible Directors consists of basic compensation, short-term incentives, and long-term incentives. Basic compensation and short-term incentives are paid in cash. Long-term incentives are paid in the form of performance-based stock compensation to promote the sharing of benefits and risks between the Directors and shareholders in addition to more strongly incentivizing medium- to long-term contribution to corporate value. For long-term incentives, points granted may be revoked in whole or in part by resolution of the Board of Directors, in given circumstances such as when an eligible Director is dismissed or resigns due to damage caused to the Company. These three components of Director compensation account for approximately 30%, 30%, and 40%, respectively, of the total, assuming that the Group's consolidated operating results and each indicator in the preceding fiscal year reached target levels and that each Director's degree of achievement of targets set for the preceding fiscal year is 100%.

Compensation Levels

Compensation levels are set appropriately, taking into consideration conditions at other companies and officer compensation survey data from an external specialized organization. Compensation levels for each position are generally as indicated below, with compensation for the Director, President, and Chief Executive set at 100. Chairman of the Board: 77 Director, President, and Chief Executive: 100 Director, Senior Corporate Executive Officer: 57

Composition of Director Compensation (Excluding Audit & Supervisory Committee Members and Outside Directors)

| Composition | Payment method | Details |

|---|---|---|

| Basic compensation (fixed compensation) | Cash | Each eligible Director’s pay grade is determined based on the missions assigned to them. |

| Short-term incentives (performance-based compensation) | Cash | Performance-based compensation is determined in line with single-year operating results and other indicators. Specifically, the amount of this compensation is determined based on consolidated operating results, the level of achievement of each eligible Director’s individual performance targets, and employee engagement indicators. With the aim of providing incentives for the steady accomplishment of single-year operating results targets and promoting the sharing of value with shareholders, profit attributable to owners of the parent is used as the indicator for assessing consolidated operating results, and set based on an after-tax ROIC equivalent to the standard of achieving the weighted average cost of capital (“WACC”) to maintain an awareness of capital efficiency. The payment ratio applied to this performance-based compensation is determined based on the profit attributable to owners of the parent for the year, as presented in (i), below. Details of the process for determining the level of achievement are presented in (ii), below. For employee engagement indicators, the payment ratio is determined according to the ratio of employees who give high scores to both “Engagement (job satisfaction)” and “Enablement (productive work environment)” in the Employee Engagement Survey, with the objective of encouraging even greater levels of performance among the human resources working at the Company. |

| Long-term incentives (fixed portion and performance-based portion) | Stock | Long-term incentives utilize a stock benefit trust and are determined based on fixed points granted to Directors in line with their periods of service as well as performance-based points granted for their accomplishments vis-à-vis individual performance targets, ESG indicators (CO2 reduction and third-party institution evaluation), and share price metric. In principle, these incentives are paid to the recipients in the form of both Company shares and cash (the latter being in an amount equivalent to the value of a portion of said shares after conversion) at the time of their retirement as Director.

Points granted are divided into fixed points and performance-based points. With regard to fixed points, value is shared with shareholders by granting a certain number of shares based on the term of service. Also, performance-based points are given as incentives to increase corporate value over the medium to long term by granting shares based on the degree of achievement of targets by each eligible director, ESG indicators, and share price metric. The degree of achievement of targets by each eligible director is the degree of achievement of targets concerning medium- to long-term issues of the entire company and the organizations and business for which each director is responsible set for each director in the previous fiscal year. For ESG indicators, evaluations are conducted based on the degree of achievement of CO2 reduction targets through the Company’s business activities and solutions provision, with the payment ratio determined in conjunction with third-party evaluations (Dow Jones Best-in-Class Index*), to encourage overall ESG-related initiatives, including those for the reduction of CO2. For share price metric, the payment ratio is established based on the degree of achievement of share price targets, to reinforce awareness regarding improvement of corporate value.

The proportions of fixed points and performance-based points are set at 30%:70% each when the recipient's level of achievement is at a standard level. Details of the process for determining the level of achievement are presented in (ii), below.

* Stock index related to sustainability by S&P Global Inc. |

Composition of Director Compensation

* In the case where the Group’s consolidated operating performance and each indicator in the preceding fiscal year reached target levels and each Director’s degree of achievement of targets set for the preceding fiscal year is 100%.

(i) Payment Ratio Based on Profit Attributable to Owners of Parent

| Profit attributable to owners of parent | Payment ratio (%) |

|---|---|

| Less than 0 | - |

| 0 to less than ¥25 billion | 0 to 45 |

| ¥25 billion to profit less than WACC equivalent | 50 to 95 |

| WACC equivalent profit to profit less than WACC + 3% equivalent | 100 to 195 |

| Profit more than WACC + 3% equivalent | 200 or more |

* The targets for profit attributable to owners of parent are set based on the level that will enable the Group to achieve after-tax ROIC commensurate with WACC and the level that will enable the Group to achieve after-tax ROIC that exceeds WACC by approximately 3%.

(ii) Process for Determining Level of Achievement of Individual Performance Targets

Setting of Targets

Each eligible Director sets their own targets in terms of addressing short-, medium- and long-term issues, including those associated with business units and operations under their supervision and Company-wide issues, with the degree to which these are achieved reflected in short-term and long-term incentives. These include targets pertaining to important financial indicators as well as non-financial indicators. Targets for the short- and medium-term issues are as described below, and actions and achievement levels for respective targets to be implemented by each eligible Director toward their realization are established.

- Targets for short-term issues: Targets to be achieved by the end of the fiscal year

- Targets for medium- to long-term issues: Targets to be achieved in light of Group Vision 2030

Methods for Assessing the Level of Target Achievement

The targets set by each eligible Director are assessed at the end of each fiscal year, and the degree of achievement is reflected in compensation. The assessment of each eligible Director is determined as described below.

- President: All Outside Directors who serve as members of the Compensation Advisory Committee conduct individual, face-to-face interviews with the President and make a determination through deliberations among those Outside Directors.

- Senior Corporate Executive Officers: Outside Directors who serve as members of the Compensation Advisory Committee conduct individual, face-to-face interviews with the Senior Corporate Executive Officers and make a determination through deliberations among those Outside Directors and the President.

- Other Directors: The President conducts individual, face-to-face interviews with the individual Directors jointly with the Senior Corporate Executive Officers, and formulates an assessment through deliberations with the Senior Corporate Executive Officers, before referring the matters to the Compensation Advisory Committee for a decision.

Compensation of Audit & Supervisory Committee Members and Outside Directors

To ensure their professional independence, compensation for these individuals consists only of fixed compensation and is not linked with performance.

Methods for Determining Compensation

The total maximum amount of compensation for Directors (excluding Audit & Compensation Committee Members) is set by a resolution passed at the General Meeting of Shareholders. Within this limit, the amount of compensation is determined by the resolution of the Board of Directors based on the deliberations of the Compensation Advisory Committee. The presiding officer and a majority of the members of the Compensation Advisory Committee are Outside Directors. The Board of Directors may also resolve to entrust the President with the responsibility of determining the amount of compensation for each Director. In such cases, however, the President is required to honor the conclusions reached via the deliberations of the Compensation Advisory Committee and comply with policies regarding the determination of the amounts of Director compensation and methods for calculating such compensation. Compensation for Audit & Supervisory Committee Members is determined by deliberations among Directors who serve as Audit & Supervisory Committee Members.

The Effectiveness of the Board of Directors

Directors’ Terms of Office/Restrictions

| Directors’ terms of office | Directors | 1 year |

|---|---|---|

| Directors (Audit & Supervisory Committee Members) | 2 years | |

| Criteria regarding restrictions on concurrent service as Director | The Board of Directors stipulates that if a director of the Company is to serve concurrently as an officer of another listed company, the maximum number of concurrent appointments is limited to three companies excluding the Company. The Company discloses the status of concurrent positions held by each director in the notice of the General Meeting of Shareholders and in the Annual Securities Report. |

Evaluating the Effectiveness of the Board of Directors

The Board of Directors strives to ensure that its members, including independent Outside Directors, engage in free, vigorous discussion based on their insights and experience and reach appropriate management decisions. As part of these efforts, since fiscal 2015, the Board of Directors annually evaluates and analyzes the effectiveness of its operations.

Efficacy Evaluation Methods

The evaluation was conducted via anonymous questionnaire to all directors with the advice and assistance of external experts. The specific evaluation procedure is as follows.

- Confirm the status of initiatives to address issues identified via the previous evaluation of the Board of Directors and determine evaluation methods to be used, key items to be surveyed and other matters pertaining to the upcoming evaluation

- Conduct a survey of all of the members of the Board of Directors

- Compile and analyze the survey results for discussion at Board of Directors meetings

- Determine issues to be addressed at Board of Directors meetings and policies for countermeasures based on findings from analysis and results of the Board of Directors’ discussion

Items Surveyed

The survey questions (main items) are as follows, with a 5-point scale and free writing section. Also, these questions take into account the changes made in the revision of the Corporate Governance Code while maintaining continuity with previous surveys.

- Survey Question Items

- (1)Optimal status of the Board of Directors

- (2)Composition of the Board of Directors

- (3)Operation of the Board of Directors

- (4)Discussions of the Board of Directors

- (5)Monitoring function of the Board of Directors

- (6)Training

- (7)Interactions with shareholders (investors)

- (8)Actions by the respondent

- (9)Audit & Supervisory Committee

- (10)Summary

|

Audits

Internal Audits (as of June 26, 2025)

With regard to internal audits, based on the inappropriate incidents at the submarine repair workplace and improper marine engine inspections, audit functions were consolidated into the Audit Group (35 members) to conduct risk-based internal audits. Simultaneously, measures that lead to the prevention of misconduct and its early detection, such as the extraction of the risk of misconduct through data analysis, are being promoted. Through these efforts, we are endeavoring to improve the internal control function of the Group. The general manager of the Audit Group reports the results of individual audits to the President and Audit & Supervisory Committee through audit reports and submits comprehensive reports to the Board of Directors and the Management Committee twice annually.

Audits Conducted by the Audit & Supervisory Committee

The Audit & Supervisory Committee comprises four Directors who serve as Audit & Supervisory Committee Members, three of whom are Outside Directors (independent directors specified in the rules of the Tokyo Stock Exchange) with no interests such as business dealing with the Company. Also, an Internal Director is appointed as full-time Audit & Supervisory Committee Member to ensure the effectiveness of audits, and members with sufficient knowledge of finance and accounting are appointed to ensure the reliability of financial reporting. All Audit & Supervisory Committee Members including Outside Directors closely share information with one another to enhance the audit functions of the Audit & Supervisory Committee. In addition, the Company has established the Office of Audit & Supervisory Committee, which has full-time employees, to assist the Audit & Supervisory Committee in the execution of its duties. The prior consent of the Audit & Supervisory Committee shall be obtained for any personnel changes, evaluations, etc. of these full-time employees, to enhance their independence from the executive directors and to ensure the effectiveness of the instructions of the Audit & Supervisory Committee.

The full-time Audit & Supervisory Committee Member attends important meetings, such as those of the Board of Directors and Management Committee, voicing opinions as needed. Through the above activities, the member works to maintain the auditing environment, gather information within the Company, and build and regularly monitor the operation of internal control systems. The full-time member also shares the information the member collects internally with the Outside Directors serving as Audit & Supervisory Committee Members on a regular basis. The Outside Directors serving as Audit & Supervisory Committee Members attend meetings of the Board of Directors and, when necessary, other important meetings, such as those of the Management Committee, voicing their opinions as needed based on their respective expert knowledge. They strive to obtain the information necessary for auditing through the above activities and to maintain the auditing environment in cooperation with the other Audit & Supervisory Committee Members. They also share information with the full-time Audit & Supervisory Committee Member by such means as attending meetings of the Audit & Supervisory Committee.

Independent Audits

With regard to independent auditing, Kawasaki undergoes audits of its financial statements by the independent auditor KPMG AZSA LLC. The Audit & Supervisory Committee receives an outline of the audit plan and a report on important audit items from the independent auditor, and the Audit & Supervisory Committee explains its auditing plan to the independent auditor. The Audit & Supervisory Committee periodically receives reports on the results of audits by the independent auditor and, conversely, the independent auditor receives reports on the results of audits by Audit & Supervisory Committee, which strives to keep lines of communication open with the independent auditor by also exchanging information and opinions. With regard to Key Audit Matters (KAM), the Audit & Supervisory Committee engages in discussion in close cooperation with the independent auditor, Directors, and the accounting department.

Internal Control System

The Board of Directors makes resolutions based on the Companies Act of Japan with respect to the Company’s basic policy on the establishment of its internal control system. In addition, at the end of each fiscal year, the status of the establishment and operation of that system is verified and reported to the Board.

Contact

If you need more information about our business,

please feel free to contact us.